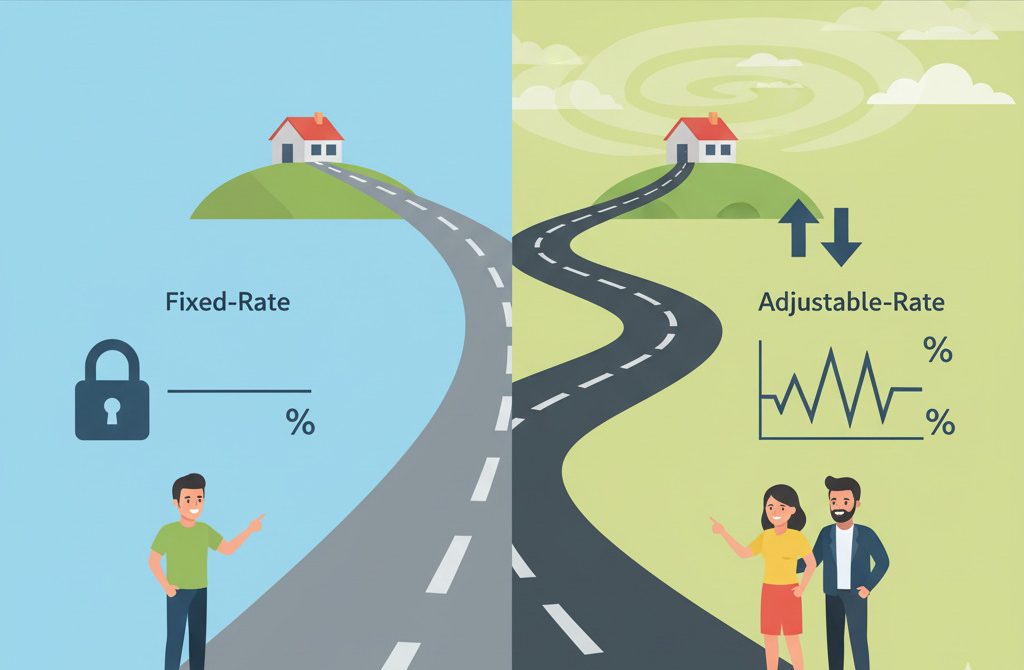

When buying a home, one of the most important decisions you’ll face is choosing between a fixed-rate mortgage and an adjustable-rate mortgage (ARM). Both options have unique advantages and drawbacks, and the right choice depends on your financial situation, risk tolerance, and long-term goals. This guide on fixed vs adjustable rate mortgages will help you understand how they work, their pros and cons, and how to decide which is best for you.

Table of Contents

- 1 What Is a Fixed-Rate Mortgage?

- 2 What Is an Adjustable-Rate Mortgage (ARM)?

- 3 Fixed vs Adjustable Rate Mortgages: A Side-by-Side Comparison

- 4 How to Decide Which Mortgage Is Right for You

- 5 FAQs About Fixed vs Adjustable Rate Mortgages

- 5.1 What is the main difference between fixed and adjustable-rate mortgages?

- 5.2 Are adjustable-rate mortgages riskier?

- 5.3 Which loan type has lower initial payments?

- 5.4 Is a fixed-rate mortgage always better?

- 5.5 What does a 5/1 ARM mean?

- 5.6 Can I refinance an ARM into a fixed-rate loan later?

- 5.7 Do ARMs ever result in lower payments over time?

- 5.8 Why do fixed-rate mortgages have higher rates than ARMs?

- 5.9 Which mortgage type is best during high inflation?

- 5.10 What happens when an ARM adjusts?

- 5.11 Do ARMs have limits on how much rates can rise?

- 5.12 How do I choose between fixed vs adjustable rate mortgages?

- 6 Final Thoughts

What Is a Fixed-Rate Mortgage?

A fixed-rate mortgage is a home loan where the interest rate remains the same for the entire term of the loan. Whether you choose a 15-, 20-, or 30-year term, your monthly principal and interest payments will stay constant.

Key Benefits of Fixed-Rate Mortgages:

- Predictability – Your payments never change, making budgeting easier.

- Long-term security – Ideal if you plan to stay in your home for many years.

- Protection from interest rate hikes – You won’t be affected if market rates rise.

Potential Downsides:

- Higher initial interest rates compared to ARMs.

- Less flexibility if you plan to move or refinance soon.

What Is an Adjustable-Rate Mortgage (ARM)?

An adjustable-rate mortgage (ARM) starts with a lower interest rate that adjusts periodically based on market conditions. For example, a 5/1 ARM means the interest rate is fixed for the first 5 years, then adjusts annually.

Key Benefits of Adjustable-Rate Mortgages:

- Lower initial rates – Great for reducing payments in the early years.

- Cost savings – Ideal if you plan to sell or refinance before the rate adjusts.

- Potential benefit from falling interest rates – Your payments could decrease.

- Potential Downsides:

- Uncertainty – Payments may increase significantly after the initial fixed period.

- Harder to budget long-term – Riskier if you plan to stay in your home long term.

- Complex terms – Caps, margins, and adjustment rules can be confusing.

Fixed vs Adjustable Rate Mortgages: A Side-by-Side Comparison

| Feature | Fixed-Rate Mortgage | Adjustable-Rate Mortgage (ARM) |

|---|---|---|

| Interest Rate | Constant for the life of the loan | Starts lower, changes periodically |

| Monthly Payments | Stable and predictable | May rise or fall over time |

| Best For | Long-term homeowners | Short-term homeowners or those expecting income growth |

| Risk Level | Low – no surprises | Higher – depends on market rates |

| Flexibility | Less flexible | More flexible, especially for short-term plans |

How to Decide Which Mortgage Is Right for You

When comparing fixed vs adjustable rate mortgages, consider these factors:

How long you plan to stay in the home

- Long-term: Fixed-rate is usually better.

- Short-term: ARM may save you money.

Your risk tolerance

- Prefer stability? Choose fixed-rate.

- Comfortable with some uncertainty? ARM could work.

Current interest rate environment

- If rates are low, locking in a fixed-rate may be wise.

- If rates are high but expected to fall, an ARM could help.

Your income stability

- Fixed-rate fits those with steady income.

- ARM may suit those expecting higher income in the future.

FAQs About Fixed vs Adjustable Rate Mortgages

What is the main difference between fixed and adjustable-rate mortgages?

Fixed-rate mortgages have constant interest rates, while ARMs start low but change over time.

Are adjustable-rate mortgages riskier?

Yes, because future payments depend on market interest rates.

Which loan type has lower initial payments?

ARMs usually start with lower payments compared to fixed-rate mortgages.

Is a fixed-rate mortgage always better?

Not necessarily—it’s better for long-term stability, but ARMs can save money short-term.

What does a 5/1 ARM mean?

It means the rate is fixed for 5 years, then adjusts annually.

Can I refinance an ARM into a fixed-rate loan later?

Yes, many homeowners refinance if rates start rising.

Do ARMs ever result in lower payments over time?

Yes, if market interest rates decrease.

Why do fixed-rate mortgages have higher rates than ARMs?

Lenders charge more for the security of a fixed rate.

Which mortgage type is best during high inflation?

A fixed-rate mortgage, since it locks in your payments.

What happens when an ARM adjusts?

Your interest rate and monthly payment may go up or down.

Do ARMs have limits on how much rates can rise?

Yes, they typically include caps on adjustments and lifetime limits.

How do I choose between fixed vs adjustable rate mortgages?

Base your choice on how long you’ll stay in the home, your risk tolerance, and market conditions.

Final Thoughts

Choosing between fixed-rate and adjustable-rate mortgages is one of the biggest financial decisions you’ll make as a homeowner. Fixed-rate mortgages offer stability and peace of mind, while ARMs provide lower initial costs and flexibility. The right choice depends on your time horizon, financial stability, and comfort with risk. By carefully weighing your options, you can select the mortgage that best fits your long-term financial goals.

Ahmad Faishal is now a full-time writer and former Analyst of BPD DIY Bank. He’s Risk Management Certified. Specializing in writing about financial literacy, Faishal acknowledges the need for a world filled with education and understanding of various financial areas including topics related to managing personal finance, money and investing and considers investoguru as the best place for his knowledge and experience to come together.